20.09.2022 11:31 AM

20.09.2022 11:31 AMThe new trading week traditionally began with an empty macroeconomic calendar. Important statistics were not published in Europe and the United States. While, there was no trading in the UK due to the funeral of Queen Elizabeth II.

Investors and traders were guided by the information flow, identifying speeches / statements / comments regarding interest rates, inflation and everything related to monetary policy.

Information flow

ECB Governing Council member Pablo Hernandez de Cos said on Monday that interest rates should be raised until inflation is sure to return to its 2.0% target.

The main points of his speech:

- Weak economic growth is not enough to bring inflation back to target levels.

- There is a danger of inflation effects of the second wave.

- Recent reports point to a rapid slowdown in the EU economy.

- Rapid rate hikes to the neutral 2.0% level may be undesirable.

The EURUSD currency pair showed an upward interest, during which the quote jumped to the value of 1.0050. Despite the temporary shift of trading forces in favor of buyers, there is still a stagnation stage along the parity level for the currency pair.

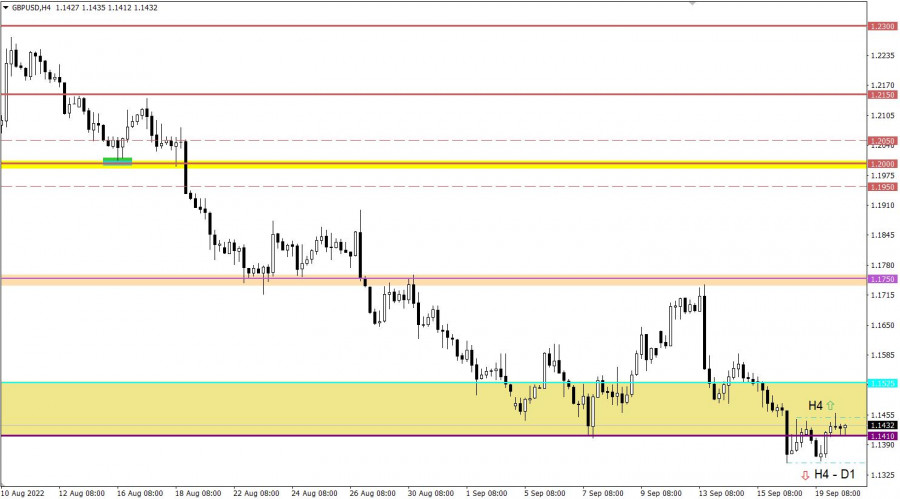

The GBPUSD currency pair did not manage to stay below the local low of the past week at 1.1350. As a result, there was a gradual increase in the volume of long positions in the pound sterling, which led to the formation of a pullback in the market.

Today, data on the construction sector of the United States will be published, which predicts a decline in all indicators. This is not the best economic signal, but it is likely that market participants will ignore them due to the release of the results of the two-day Fed meeting on Wednesday.

Thus, investors and traders will continue to monitor the incoming information flow, identifying possible speeches / statements / comments regarding interest rates, inflation and everything related to monetary policy.

Time targeting:

U.S. Building Permits Issued (Aug) – 12:30 UTC

U.S. Housing Starts (Aug) – 12:30 UTC

In this situation, the primary signal of rising interest among traders was received from the market. To confirm it, the quote needs to stay above the value of 1.0050. In this case, movement in the direction of 1.0150 is possible.

Otherwise, the quote will return to the previous cycle of fluctuations along the parity level.

The downside scenario is still relevant in the market, but in order for it to be confirmed, the quote needs to stay below 1.1350 for at least a four-hour period. Until then, traders will see a corrective move as a possible market opportunity. The subsequent increase in the volume of long positions on the pound is expected after holding the price above the value of 1.1450 in a four-hour period.

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

歐元/美元貨幣對在周三的一半時間內出現了上升趨勢。雖然這次歐元的最新「激增」尤其「令人印象深刻」,但很可能只是美元的又一次下跌。

EUR/USD 貨幣對在週三繼續上行,但僅是短暫的。在下午時段,歐元開始下跌,儘管缺乏支持此類變動的宏觀經濟因素。

週二,英鎊/美元貨幣對經歷了顯著增長,儘管背後並無明確的推動因素。週一,美元因為特定原因走強,但週二卻毫無原因地下跌,只因為這就是美元。

週二,英鎊兌美元貨幣對輕鬆從週一的損失中恢復過來。我們再次觀察到,英鎊上漲的幅度比歐元大,下降時更為溫和。

歐元/美元貨幣對輕鬆收復了週一的大部分失地。週一有報導稱,中美之間的進口關稅已經降低,這可以合理地看作是貿易戰降溫的跡象。

週一,英鎊/美元組合也大幅下跌,不過更準確的說法是美元顯示出強勁的增長。近幾個月來,幾乎所有市場的波動都與美元有關。

週一,歐元/美元貨幣對大幅下跌。交易者可能已經習慣於美國美元無法顯著增長的想法,但我們曾警告,如果貿易戰的升級出現逆轉,美元將升值。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.