18.07.2022 10:35 AM

18.07.2022 10:35 AMConsequently, during the 11–15 June auction, the EUR/USD currency pair maintained its downward trend, reaching a price of 0.9953. In a moment, we'll examine the technical picture of the primary currency pair in further detail; for now, we'll speak briefly about other data. This week, the European Central Bank will hold a meeting, after which a decision will be taken about interest rates. The mainstream expectation assumes that the ECB will raise the key interest rate by 25 basis points. However, will this be sufficient to convince the market of the decisiveness of tightening monetary policy to confront high inflation? It may be the fundamental question determining the future of the most important currency pair in the Forex market. According to the author's personal opinion, such a tardy and previously publicized hike in the key rate has already been factored into the price of the single European currency, and if that is the case, then support for the euro from this decision of the European Central Bank is unlikely. Nonetheless, the technical picture indicates a potential reversal of the euro/dollar, at least for a corrective drop. The EUR/USD weekly chart is studied.

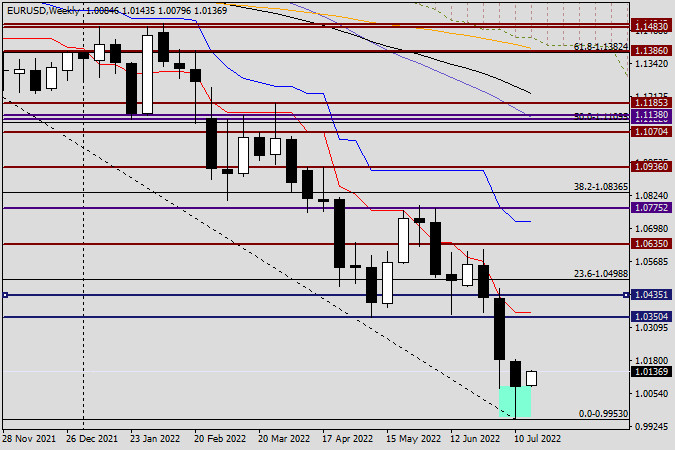

Weekly

On the weekly timescale, a candle with a suitably long-emphasized lower shadow has been generated based on the trading activity of the previous five days. The fact that this candle arose after attempting to fall below the most significant psychological and historical threshold of 1.0000 is a defining aspect of its appearance. Now that so much has been written about the accomplishment of EUR/USD parity, it has finally captured the attention of market participants. Last week, the price closed at 1.0078 after bouncing off this key level. This week's trading begins at a time when euro bulls are attempting to continue reducing the previous large losses. Given the long lower shadow of the previous candle and the impending ECB rate hike, I believe the major currency pair has a chance of exhibiting an upward trend based on the outcomes of trading over the past five days.Nevertheless, a great deal will depend on the words of ECB leaders. If a clear signal is received regarding a further and more forceful tightening of monetary policy, the probability of a last weekly increase will unquestionably increase. Without ECB support, it is doubtful that the single European currency will require support. On a weekly price chart, the region between 1.0350 and 1.0370 appears to be the closest growth objective. If the bearish trend continues, the bears will retest the 0.9953 minimum value from the previous week for a potential breakdown.

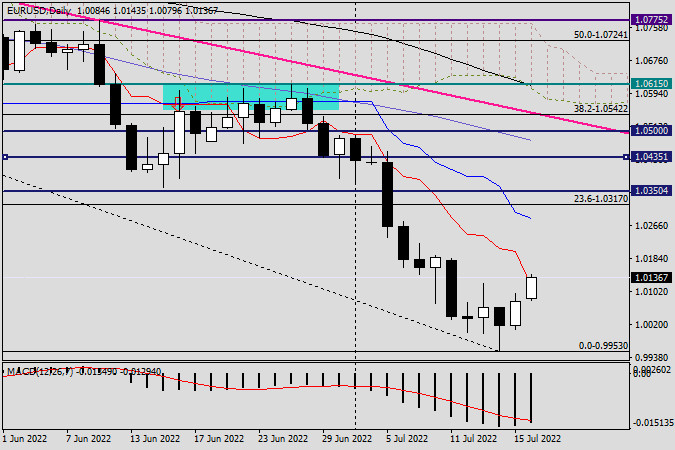

Daily

On the daily chart, the red Tenkan line of the Ichimoku indicator is being tested for a break higher during the current upward trend. If these efforts are successful, the pair may ascend to the blue Kijun line, which is located at 1.0284. I believe the capacity to climb the Kijun will play a significant role. Despite the negative trend in EUR/USD, I will not be shocked by the ensuing upward movement, which should still be deemed corrective. Tomorrow's article will examine smaller time intervals to identify favorable entry points for euro/dollar bets. Given the discussed timelines, I lean toward a positive scenario.

歐元/日元(EUR/JPY)貨幣對持續表現出穩定的正面動態。現貨價格保持在三週高點附近。

今天,紐幣/美元(NZD/USD)組合繼續受到買家的青睞,儘管仍維持在0.6050水準以下。所有時間框架中的振盪指標皆處於正區域,並遠離超買區,這確認了該組合的正面展望。

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

电子邮件/短信

通知

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.