13.10.2021 12:30 PM

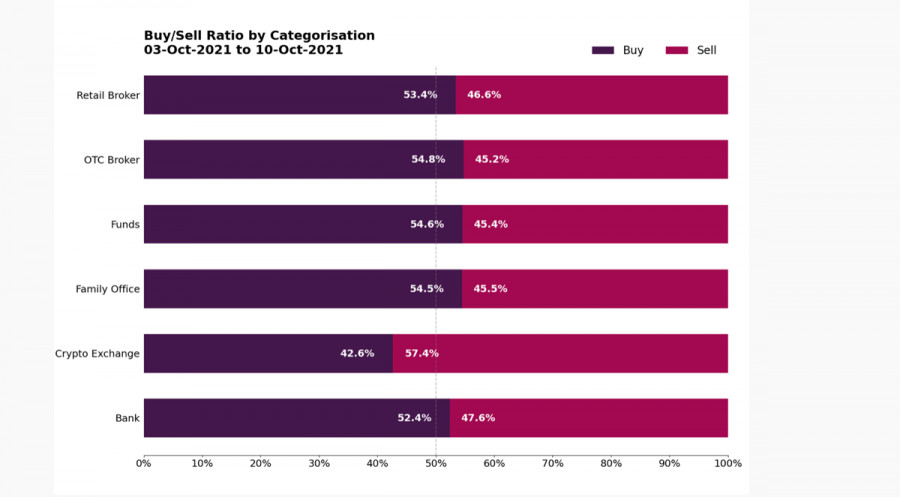

13.10.2021 12:30 PMSuch players turned out to be institutional investors who caused the current bullish BTC rally. This was stated by the experts of the analytical company B2C2. Currently, the market has a fragile balance with a weak dominance of buyers, which is natural given the growth of the BTC/ USD pair. On cryptocurrency platforms, the situation is different: for the period from the beginning of September to October, users preferred to sell their stocks of the first coin. This suggests that the dynamics of cryptocurrency exchanges stand out from the general mood of the market. Platforms for retail and simplified use are the only exception in the entire market, where there is a significant preponderance towards asset sales. It would be quite reasonable to note that this could have been facilitated by the September collapses of the cryptocurrency, which did not scare off only seasoned players, but this is not so. According to the data of the same analytical company, in the period from October 3 to October 10, the following ratio of longs /shorts was observed on cryptocurrency platforms - 42% to 57%.

This is direct evidence that retail traders were betting on Bitcoin decline, and the upward trend in the number of unique addresses was dictated solely by manipulative and short-term plans of traders. However, as it was already clear in August, the BTC market is moving towards expanding trend cycles, and so, short-term investors do not get the necessary results and only slow down the growth of bitcoin prices. Despite this, there is a tendency that the number of retailers will fall due to the continued influx of institutions. This will make the asset more predictable and eliminate the likelihood of local panic sales. In addition, the 30% rise in Bitcoin over the past two weeks suggests that the market has enough bullish strength to set new highs even without significant support from retail traders.

Despite all the positivity, Bitcoin underwent a correction yesterday and tested the strength of the support line at $55,500, after which the price recovered above the level of $56,500. However, BTC began to decline again and broke the level of $ 50,000. Over the past day, the asset has fallen by 4% and is trading around $54,700. Bearish signals are visible on the daily chart, which was facilitated by the formation of a red candle with a long lower wick.

At the same time, technical indicators of the cryptocurrency began to decline, despite the fact that the price found a stable support line at $54,500. The MACD indicator is moving sideways, which indicates the loss of the upward momentum of the bullish wave. The stochastic oscillator formed a bearish intersection and dropped below the 70 mark, and the relative strength index continues to decline after the stochastic and has already approached 60. Everything points to a breakdown of $54.5k and further downward movement to the nearest support zone around the $53,700 mark.

This line will most likely be the last one, as the first steps towards stabilization of the situation are visible on the four-hour chart. Stochastic and RSI index managed to turn around and are moving sideways, which indicates the loss of strength in the downward wave. Despite this, MACD continues to decline to the zero level, so we should expect a period of stabilization and consolidation in the near future, gravitating towards the lower border of the support area.

比特幣繼續形成看漲趨勢結構。目前是否有真正的理由支撐新的看漲趨勢尚可商榷,但圖表毫無疑問地顯示了這一點。

在週四,比特幣的價格達到了111,770這一目標水平。Marlin振盪器似乎落後於價格,這給人一種可能的背離印象——儘管是不尋常的。

根據近期的表現來看,比特幣需求似乎正在激增。截至本文發表時,BTC/USD 交易對的交易價格接近 111,200.00,稍低於今日及歷史高點 111,865.00。

近月來,我們在 BTC/USD 的4小時圖表上觀察到波動模式越來越複雜。我們觀察到一個糾正向下的結構,這個結構在約 75,000 級別完成了形成。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.