USDMXN (美元 vs 墨西哥比索). 汇率和在线图表。

货币转换器

20 Jun 2025 01:26

(0%)

前一天收盘价

开盘价。

最后一个交易日的最高价。

最后一个交易日的最低价。

在过去52周的价格区间高点

在过去52周的价格区间低点

USD/MXN (United States Dollar vs Mexican Peso)

USD/MXN is actively traded on Forex. This currency pair is gaining more popularity among traders since the Mexican peso became freely convertible against the other currencies on the market in 2008.

To date, Mexico is one of the most developed countries in Latin America, taking the leading position among them in terms of per capita income. The Mexican economy is mainly represented by the private sector as in 1980s there was a mass privatization program aimed at fighting against the crisis. Thus, the majority of Mexican enterprises are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country has an active trade with its neighbors - the United States and Canad - which makes up the largest part of the country's income.

Mexico is the major exporter of oil in its region. Currently, most of the country's revenues are generates by oil sector. However, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. The Mexican government has to reduce the volumes of extracted oil and natural gas to avoid new problems in the economy. According to forecasts, the country will soon be forced to import oil from abroad to meet the needs of its economy. All these circumstances have a significant impact on the Mexican national currency which is largely dependent on world oil prices. In addition, the Mexican peso exchange rate hinges on international ranking of the country which is calculated by the leading rating agencies.

See Also

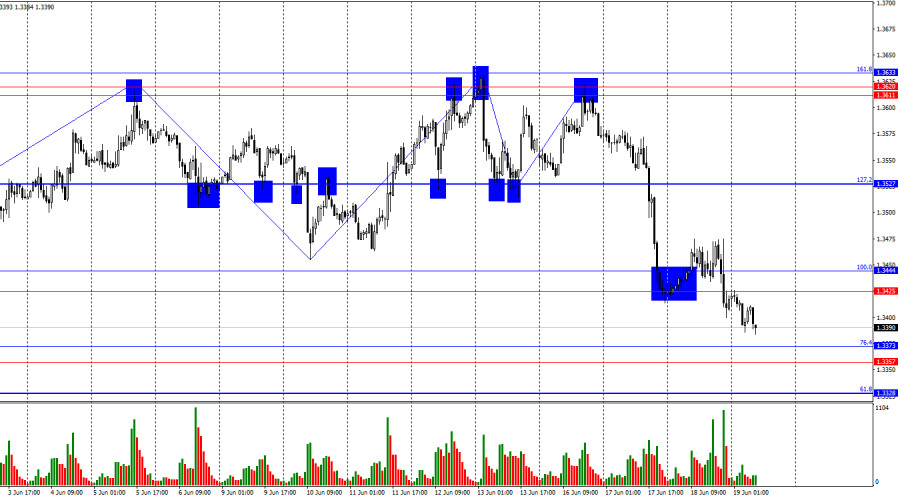

- Bulls failed to break through the resistance zone of 1.3611–1.3633.

Author: Samir Klishi

11:13 2025-06-19 UTC+2

1288

Bears moved into a slow offensiveAuthor: Samir Klishi

11:20 2025-06-19 UTC+2

1198

The GBP/USD rate remained nearly unchanged on Wednesday and rose by several dozen points todayAuthor: Chin Zhao

20:20 2025-06-19 UTC+2

748

- Treasury yields pared earlier losses after Fed Chair Powell's remarks. Middle East tensions linger as Iranian leader rebuffs Trump's surrender demands. Swiss National Bank cuts rates to zero. Stora Enso surges after forest assets review begins. Indices: Dow slips 0.1%, S&P 500 down 0.03%,.

Author: Gleb Frank

14:05 2025-06-19 UTC+2

718

Technical analysis / Video analyticsForex forecast 19/06/2025: EUR/USD, USD/CHF, GBP/USD, Oil and Bitcoin

Technical analysis of EUR/USD, USD/CHF, GBP/USD, Oil and BitcoinAuthor: Sebastian Seliga

13:52 2025-06-19 UTC+2

553

Technical analysisTrading Signals for GOLD (XAU/USD) for June 19-22, 2025: sell below $3,390 (21 SMA - 8/8 Murray)

A return above 3,390 could change the gold cycle, and we could expect it to reach 3,437 and even the psychological level of 3,500.Author: Dimitrios Zappas

15:14 2025-06-19 UTC+2

553

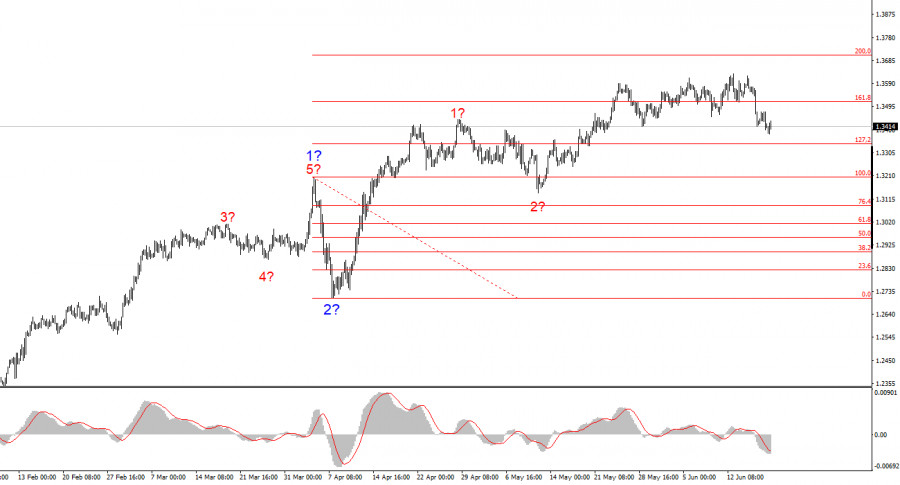

- In recent weeks, the BTC/USD instrument has been trading between $101,560 (76.4% Fibonacci) and $109,970 (100.0% Fibonacci).

Author: Chin Zhao

11:07 2025-06-19 UTC+2

538

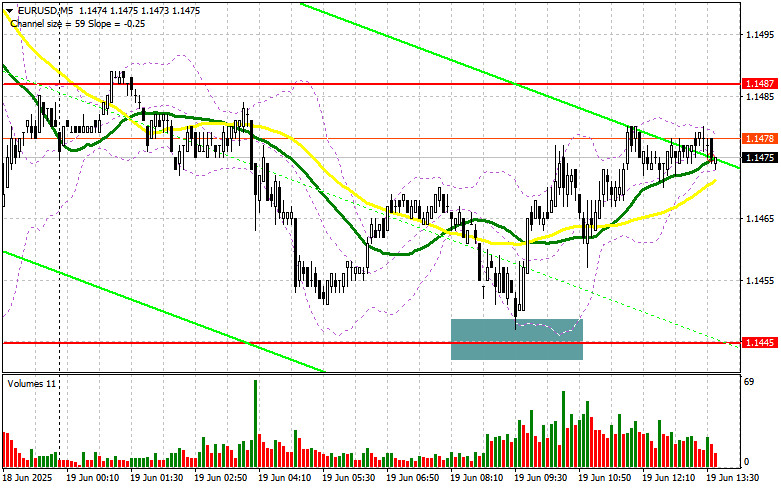

EUR/USD: Trading Plan for the U.S. Session on June 19th (Review of Morning Trades)Author: Miroslaw Bawulski

19:58 2025-06-19 UTC+2

523

Technical analysisTechnical Analysis of Daily Price Movement of Nasdaq 100 Index, Thursday June 19, 2025.

Although on its daily chart the Nasdaq 100 index appears to be moving aboveAuthor: Arief Makmur

11:45 2025-06-19 UTC+2

523

- Bulls failed to break through the resistance zone of 1.3611–1.3633.

Author: Samir Klishi

11:13 2025-06-19 UTC+2

1288

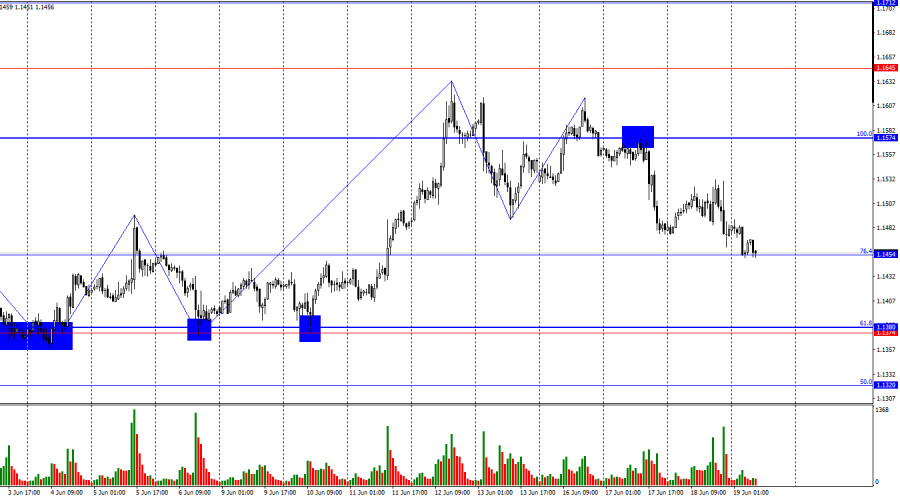

- Bears moved into a slow offensive

Author: Samir Klishi

11:20 2025-06-19 UTC+2

1198

- The GBP/USD rate remained nearly unchanged on Wednesday and rose by several dozen points today

Author: Chin Zhao

20:20 2025-06-19 UTC+2

748

- Treasury yields pared earlier losses after Fed Chair Powell's remarks. Middle East tensions linger as Iranian leader rebuffs Trump's surrender demands. Swiss National Bank cuts rates to zero. Stora Enso surges after forest assets review begins. Indices: Dow slips 0.1%, S&P 500 down 0.03%,.

Author: Gleb Frank

14:05 2025-06-19 UTC+2

718

- Technical analysis / Video analytics

Forex forecast 19/06/2025: EUR/USD, USD/CHF, GBP/USD, Oil and Bitcoin

Technical analysis of EUR/USD, USD/CHF, GBP/USD, Oil and BitcoinAuthor: Sebastian Seliga

13:52 2025-06-19 UTC+2

553

- Technical analysis

Trading Signals for GOLD (XAU/USD) for June 19-22, 2025: sell below $3,390 (21 SMA - 8/8 Murray)

A return above 3,390 could change the gold cycle, and we could expect it to reach 3,437 and even the psychological level of 3,500.Author: Dimitrios Zappas

15:14 2025-06-19 UTC+2

553

- In recent weeks, the BTC/USD instrument has been trading between $101,560 (76.4% Fibonacci) and $109,970 (100.0% Fibonacci).

Author: Chin Zhao

11:07 2025-06-19 UTC+2

538

- EUR/USD: Trading Plan for the U.S. Session on June 19th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:58 2025-06-19 UTC+2

523

- Technical analysis

Technical Analysis of Daily Price Movement of Nasdaq 100 Index, Thursday June 19, 2025.

Although on its daily chart the Nasdaq 100 index appears to be moving aboveAuthor: Arief Makmur

11:45 2025-06-19 UTC+2

523