AUDMXN (Australian Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

19 Jun 2025 12:50

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/MXN is not a very popular currency pair on Forex. AUD/MXN represents the cross rate against the U.S. dollar. Although the U.S. dollar obviously is not present in this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/MXN price charts, you can get and approximate AUD/MXN chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that AUD and MXN could respond differently towards changes in the U.S. economy, therefore, the AUD/MXN currency pair may be a specific indicator reflecting changes within the two currencies.

To date, Mexico is one of the most developed countries in Latin America. The country ranks first among Latin American countries in terms of per capita income. The Mexican economy is largely composed of private sector, due to mass privatization of state enterprises mostly in the 80s of last century to overcome the economic crisis. For the most part the former state-owned enterprises in Mexico are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, this country has an active trade with its rich neighbors - the United States and Canada, which is a significant part of government revenue in Mexico.

Mexico is the largest exporter of oil in its region. Currently most of the country’s revenues are generated in the oil sector. However, despite this, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. This makes the government to reduce the amount of extracted oil and natural gas in order to avoid new problems in the economy. According to the forecasts, with such a policy, Mexico will soon be forced to import oil from abroad, to meet the needs of its economy. All these circumstances have a significant impact on the currency of Mexico, which is largely dependent on world oil prices, which are formed in global financial markets. In addition, the Mexican peso exchange rate is highly dependent on international ranking of the country, which is based on complex economic formulas calculated by major rating agencies.

This trading instrument is relatively illiquid compared it with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when analyzing this financial instrument, focus primarily on those currency pairs that include a U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

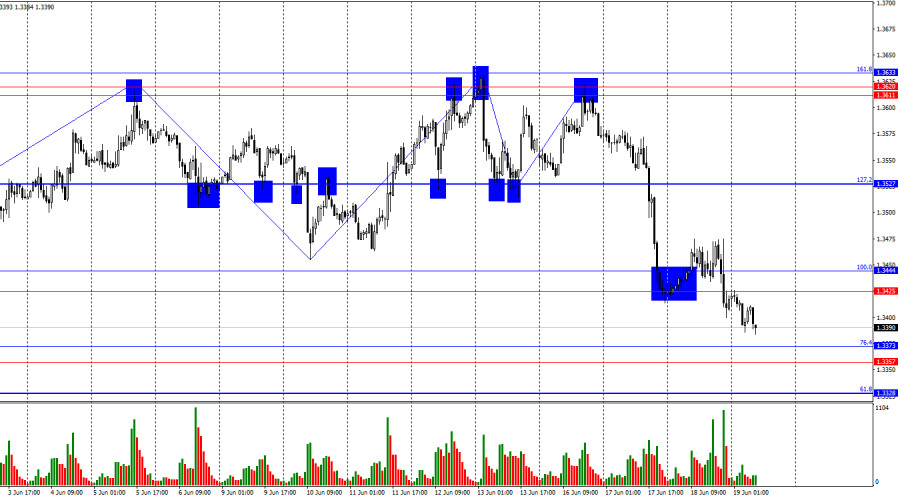

- Bulls failed to break through the resistance zone of 1.3611–1.3633.

Author: Samir Klishi

11:13 2025-06-19 UTC+2

1288

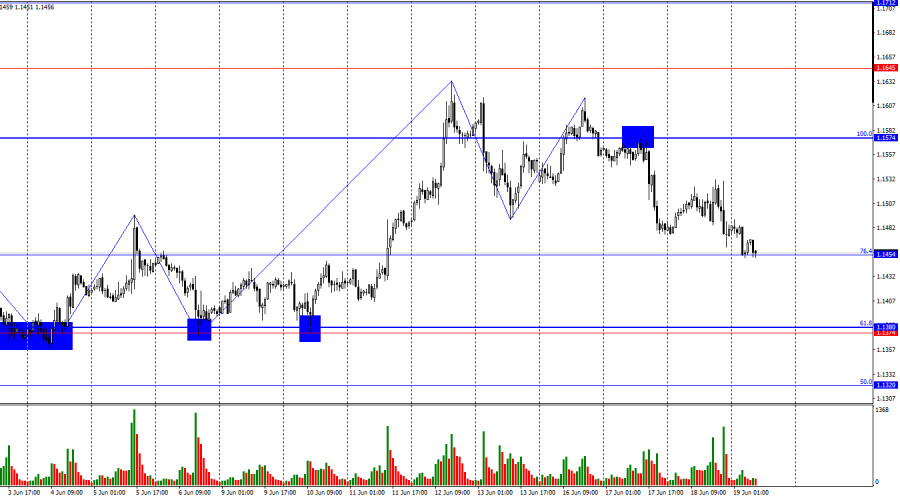

Bears moved into a slow offensiveAuthor: Samir Klishi

11:20 2025-06-19 UTC+2

1198

Fundamental analysisThe Iran-Israel War Has Yet to Exert Significant Negative Influence on Markets (Limited downside risk for gold and upward momentum for #USDX remains possible)

As expected, the U.S. central bank left all key monetary policy parameters unchanged, once again citing ongoing uncertainty about the future state of the national economyAuthor: Pati Gani

09:14 2025-06-19 UTC+2

1153

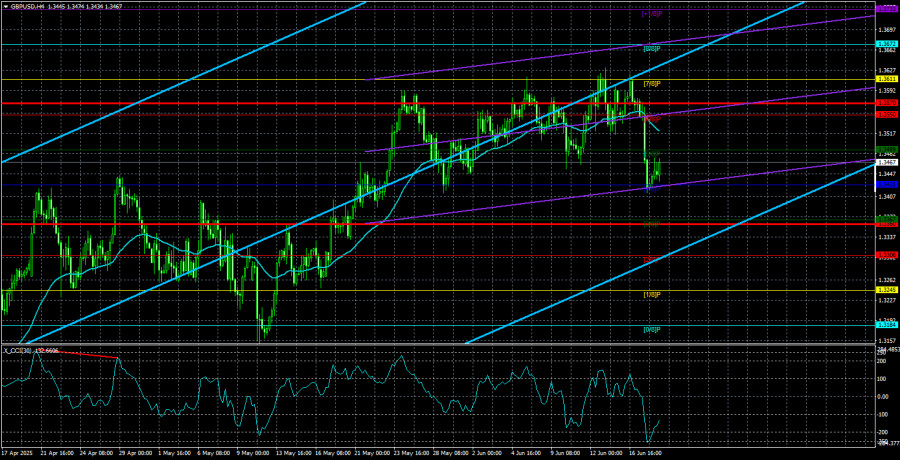

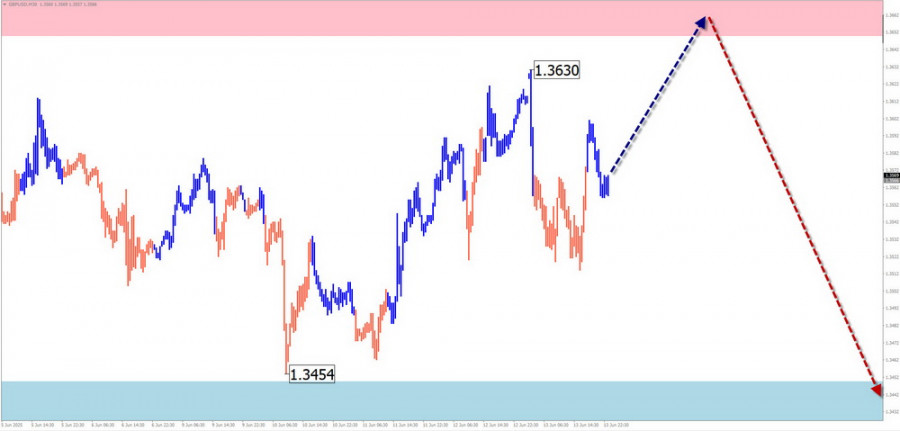

- The GBP/USD currency pair traded relatively calmly on Wednesday, though the day before, it had posted a substantial decline in the second half of the session—more than 100 pips

Author: Paolo Greco

04:02 2025-06-19 UTC+2

553

In recent weeks, the BTC/USD instrument has been trading between $101,560 (76.4% Fibonacci) and $109,970 (100.0% Fibonacci).Author: Chin Zhao

11:07 2025-06-19 UTC+2

523

The Fed Maintains Its Previous PositionAuthor: Jakub Novak

10:58 2025-06-19 UTC+2

508

- Stock Market as of May 19th: S&P 500 and NASDAQ Decline After Fed Meeting

Author: Jakub Novak

10:54 2025-06-19 UTC+2

508

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD – June 19th

The upcoming week is expected to be flat for the euro. A reversal and downward movement are anticipated from the resistance zone by midweek. The projected support zone indicates the most probable end of the correction.Author: Isabel Clark

10:50 2025-06-19 UTC+2

508

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index – June 19th

At the beginning of the upcoming week, the British pound may complete its upward movement, possibly reaching the resistance zone. Afterward, we can expect the currency's fluctuations to shift into a sideways range. Closer to the weekend, the likelihood of a trend reversal and the beginning of a.Author: Isabel Clark

10:45 2025-06-19 UTC+2

508

- Bulls failed to break through the resistance zone of 1.3611–1.3633.

Author: Samir Klishi

11:13 2025-06-19 UTC+2

1288

- Bears moved into a slow offensive

Author: Samir Klishi

11:20 2025-06-19 UTC+2

1198

- Fundamental analysis

The Iran-Israel War Has Yet to Exert Significant Negative Influence on Markets (Limited downside risk for gold and upward momentum for #USDX remains possible)

As expected, the U.S. central bank left all key monetary policy parameters unchanged, once again citing ongoing uncertainty about the future state of the national economyAuthor: Pati Gani

09:14 2025-06-19 UTC+2

1153

- The GBP/USD currency pair traded relatively calmly on Wednesday, though the day before, it had posted a substantial decline in the second half of the session—more than 100 pips

Author: Paolo Greco

04:02 2025-06-19 UTC+2

553

- In recent weeks, the BTC/USD instrument has been trading between $101,560 (76.4% Fibonacci) and $109,970 (100.0% Fibonacci).

Author: Chin Zhao

11:07 2025-06-19 UTC+2

523

- The Fed Maintains Its Previous Position

Author: Jakub Novak

10:58 2025-06-19 UTC+2

508

- Stock Market as of May 19th: S&P 500 and NASDAQ Decline After Fed Meeting

Author: Jakub Novak

10:54 2025-06-19 UTC+2

508

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD – June 19th

The upcoming week is expected to be flat for the euro. A reversal and downward movement are anticipated from the resistance zone by midweek. The projected support zone indicates the most probable end of the correction.Author: Isabel Clark

10:50 2025-06-19 UTC+2

508

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, EUR/GBP, and the US Dollar Index – June 19th

At the beginning of the upcoming week, the British pound may complete its upward movement, possibly reaching the resistance zone. Afterward, we can expect the currency's fluctuations to shift into a sideways range. Closer to the weekend, the likelihood of a trend reversal and the beginning of a.Author: Isabel Clark

10:45 2025-06-19 UTC+2

508