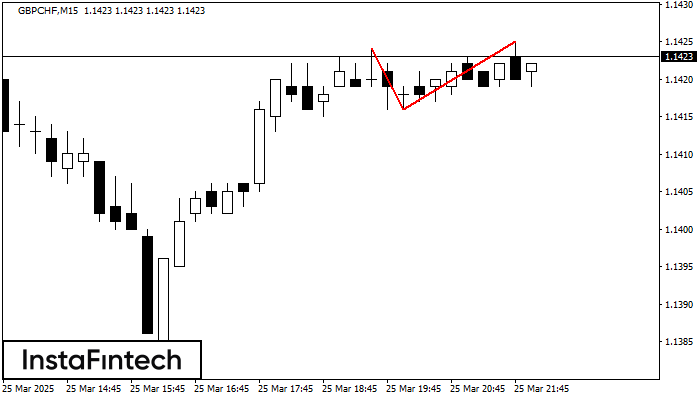

Double Top

was formed on 25.03 at 22:17:10 (UTC+0)

signal strength 2 of 5

On the chart of GBPCHF M15 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 1.1425; the lower boundary 1.1416; the width of the pattern 9 points. The signal: a break of the lower boundary will cause continuation of the downward trend targeting the 1.1394 level.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

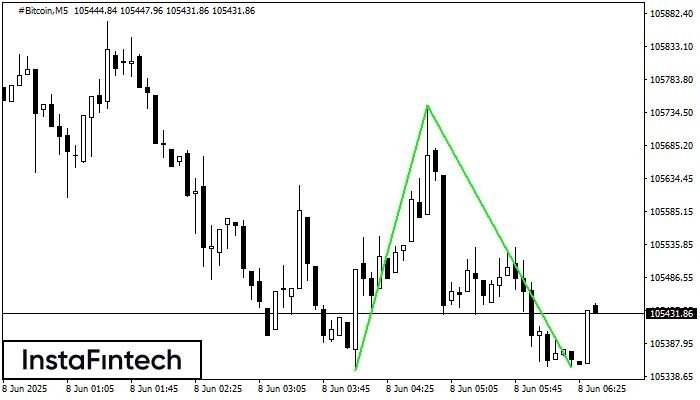

Double Bottom

was formed on 08.06 at 05:35:30 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on #Bitcoin M5. Characteristics: the support level 105347.39; the resistance level 105744.30; the width of the pattern 39691 points. If the resistance level

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

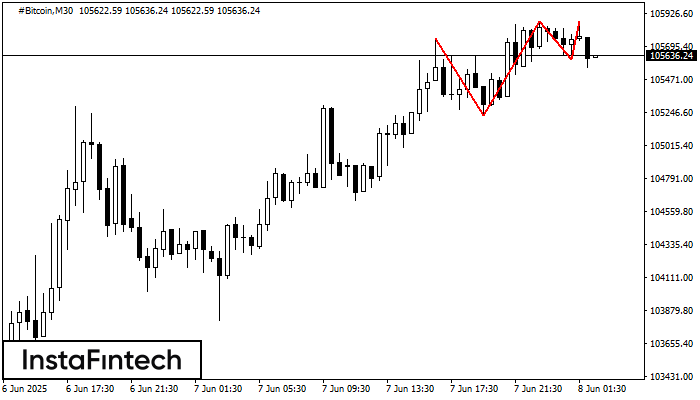

Triple Top

was formed on 08.06 at 01:30:12 (UTC+0)

signal strength 2 of 5

The Triple Top pattern has formed on the chart of the #Bitcoin M15. Features of the pattern: borders have an ascending angle; the lower line of the pattern

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Triple Top

was formed on 08.06 at 01:30:01 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the #Bitcoin M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level -11522, support level -38318

Open chart in a new window