#SPX (S&P 500 Index). Exchange rate and online charts.

Currency converter

28 Mar 2025 04:41

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Composed by Standard & Poor's, the S&P 500 index was introduced in 1923. It is a market-capitalization-weighted index that is associated with many ticker symbols, including GSPC, INX, and $SPX.

The S&P 500 index includes 500 components which are stocks of large companies traded at the New York Stock Exchange (NYSE) or the NASDAQ. The S&P 500 index reflects the overall capitalization rate of these stocks. The list of companies in the S&P 500 comprises only the biggest U.S. corporations and does not include private firms and companies with insufficient liquidity. In addition, the list of S&P 500 components represents various sectors of the U.S. economy. Due to the fact that the majority of the index components are American companies, many experts consider it an accurate indicator of the U.S. current economic conditions as well as its future changes. The main trait of the index is its role in the world economy: the S&P 500 is well-diversified and perfectly mirrors the U.S. market state.

According to analysts, there are several advantages of trading the S&P 500. One of them is an opportunity to trade on the U.S. stock market via CFDs on the leading stock index. Besides, this index is a great trading tool for traders because it has high liquidity and is traded within convenient hours of the American trading session.

See Also

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1558

President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.Author: Gleb Frank

12:15 2025-03-27 UTC+2

1393

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1273

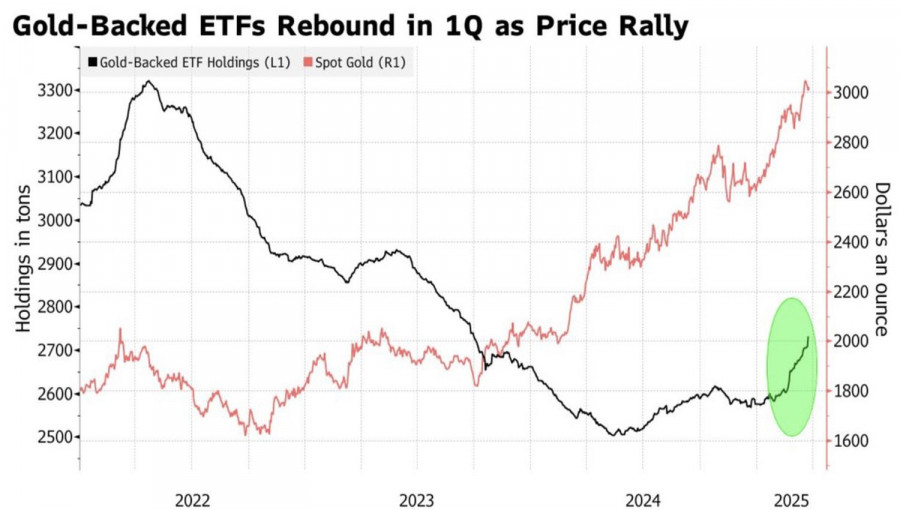

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1258

Technical analysis of EUR/USD, USD/JPY, USDX and BitcoinAuthor: Sebastian Seliga

12:24 2025-03-27 UTC+2

1228

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

1123

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1078

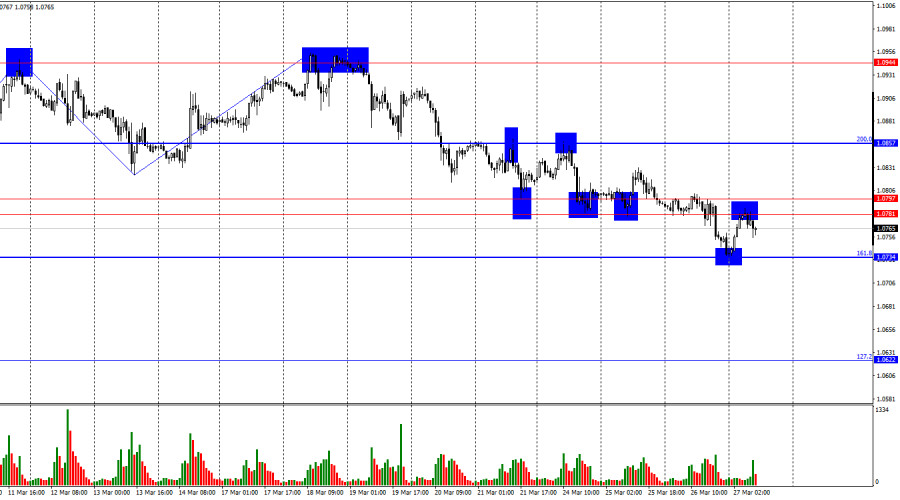

Technical analysisTrading Signals for EUR/USD for March 27-29, 2025: buy above 1.0790 (21 SMA - 8/8 Murray)

If the euro continues its rebound and consolidates above 1.0790 in the coming hours, we could expect EUR/USD to continue rising. So, the instrument could reach +2/8 Murray at 1.0986 in the short term and even the psychological level of 1.10.Author: Dimitrios Zappas

14:55 2025-03-27 UTC+2

928

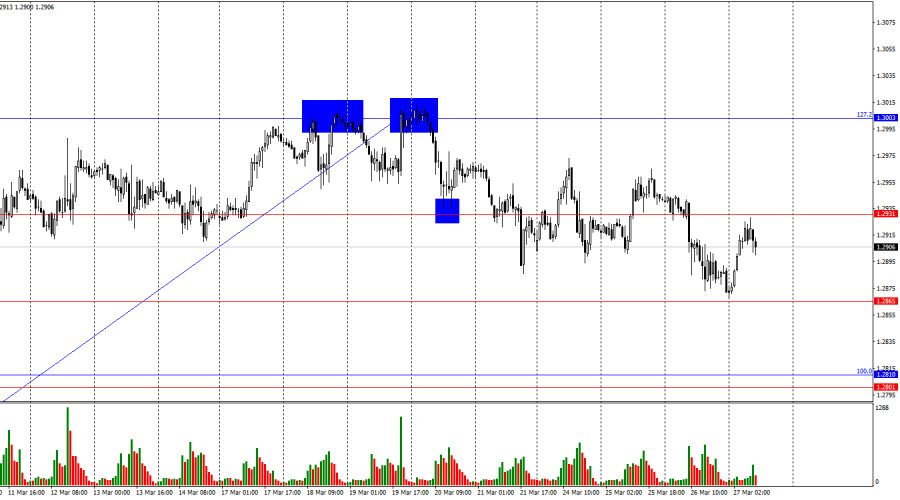

Bulls had been attacking for two weeks, but their strength had run out.Author: Samir Klishi

11:37 2025-03-27 UTC+2

898

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1558

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1393

- US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and Europe

Author: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1273

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1258

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1228

- Once you understand how the system works, winning isn't hard

Author: Marek Petkovich

11:55 2025-03-27 UTC+2

1123

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

1078

- Technical analysis

Trading Signals for EUR/USD for March 27-29, 2025: buy above 1.0790 (21 SMA - 8/8 Murray)

If the euro continues its rebound and consolidates above 1.0790 in the coming hours, we could expect EUR/USD to continue rising. So, the instrument could reach +2/8 Murray at 1.0986 in the short term and even the psychological level of 1.10.Author: Dimitrios Zappas

14:55 2025-03-27 UTC+2

928

- Bulls had been attacking for two weeks, but their strength had run out.

Author: Samir Klishi

11:37 2025-03-27 UTC+2

898