CADHUF (Canadian Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

27 Jun 2025 23:59

(0.05%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The CAD/HUF pair is quite popular among some Forex traders. This trading instrument is a cross rate against the US dollar, which has a significant impact on the pair. So, when comparing the CAD/USD and USD/HUF charts, we can get an almost clear picture of CAD/HUF movements.

Features of CAD/HUF

The Canadian dollar is highly correlated with global oil prices. Canada is one of the largest oil-exporting countries. For this reason, the Canadian dollar strengthens when the value of the commodity rises and weakens when oil falls. Therefore, the CAD/HUF pair is dependent on the world price of this fuel.

Although Hungary is part of the European Union, it has its own national currency, the forint.

The Hungarian economy depends strongly on the organizations and countries that do business in its territory. The state is characterized by a high share of foreign capital in the economy.

A large part of Hungary's income is generated by tourism. In addition, such sectors of the economy as engineering, metallurgy, chemical industry, and agriculture are also flourishing in the country. Most of the production is exported abroad. Hungary's main trading partners are the EU countries and Russia. Therefore, when assessing the future exchange rate of the Hungarian forint, special attention should be paid to the economic indicators of these regions.

How to trade CAD/HUF

When trading cross rates, remember that brokers usually set a higher spread on such pairs than on more popular currency pairs. Therefore, before starting to work with cross-rate pairs, you should carefully study the trading conditions of the broker.

The CAD/HUF pair is a cross rate. Therefore, the US dollar has a significant impact on each of the currencies in this trading instrument. For this reason, when predicting the movement of the pair, it is necessary to take into account the major US economic indicators. These include the refinancing rate, GDP growth, unemployment, number of new jobs, and many others. Notably, the currencies mentioned above may react differently to changes taking place in the US economy. Therefore, CAD/HUF could be an indicator of fluctuations in these currencies.

See Also

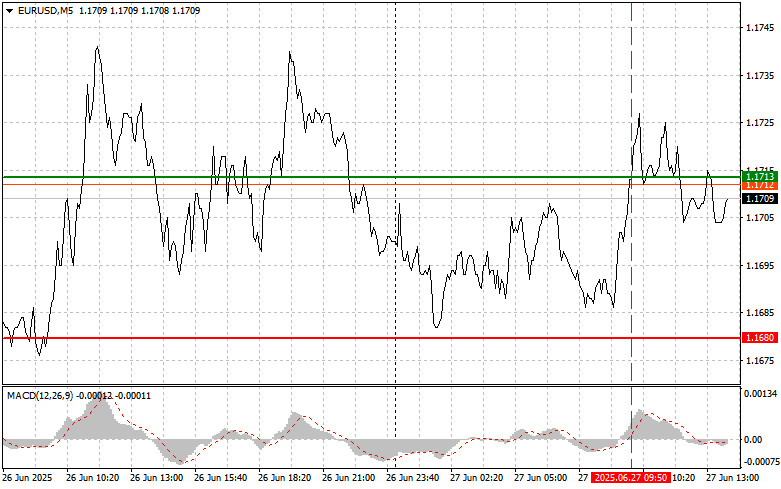

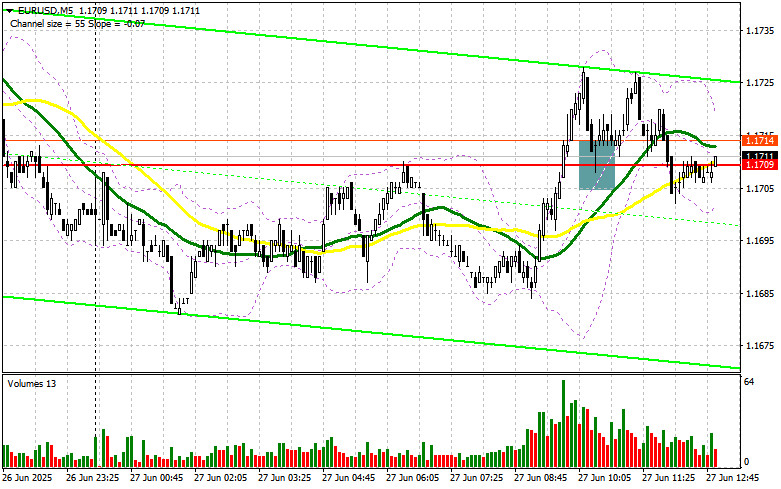

- EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)

Author: Jakub Novak

13:11 2025-06-27 UTC+2

2578

Gold is attracting fresh sellers today, having fallen below the psychological $3300 level.Author: Irina Yanina

10:47 2025-06-27 UTC+2

2533

Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

2518

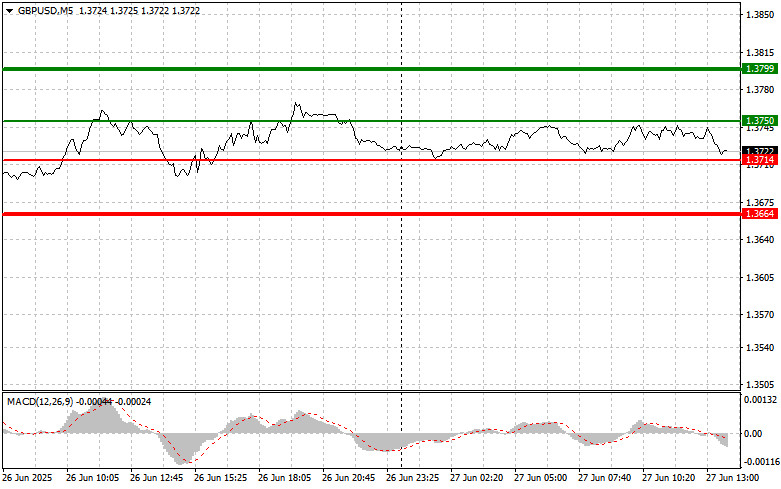

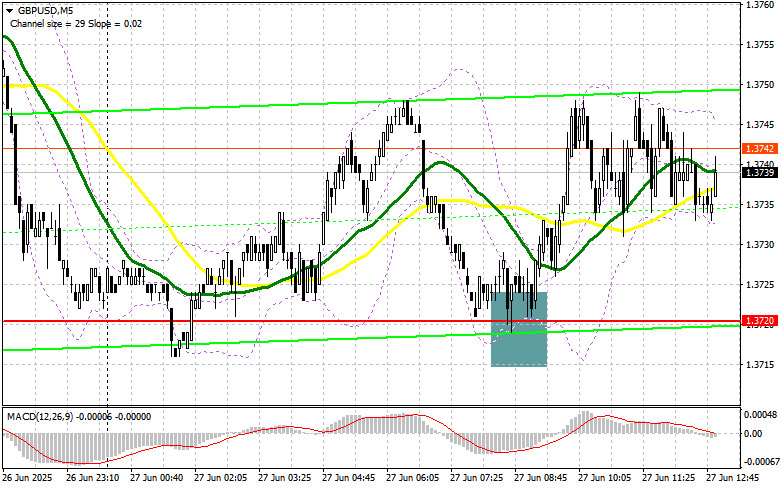

- GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:16 2025-06-27 UTC+2

2413

GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2413

EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2383

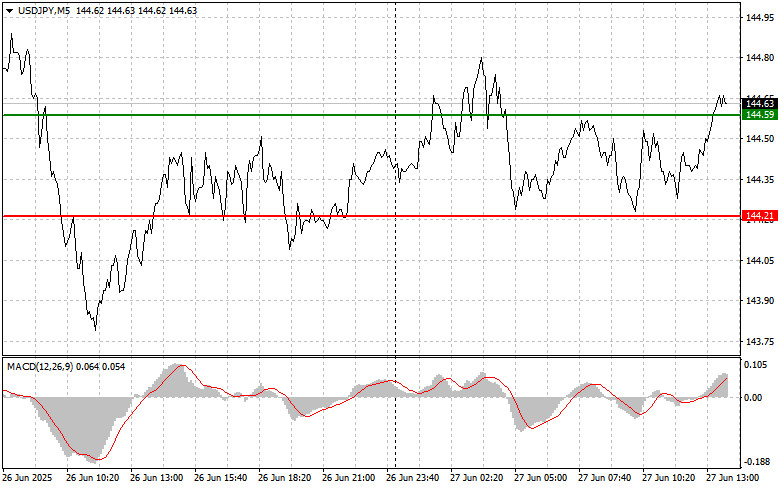

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2338

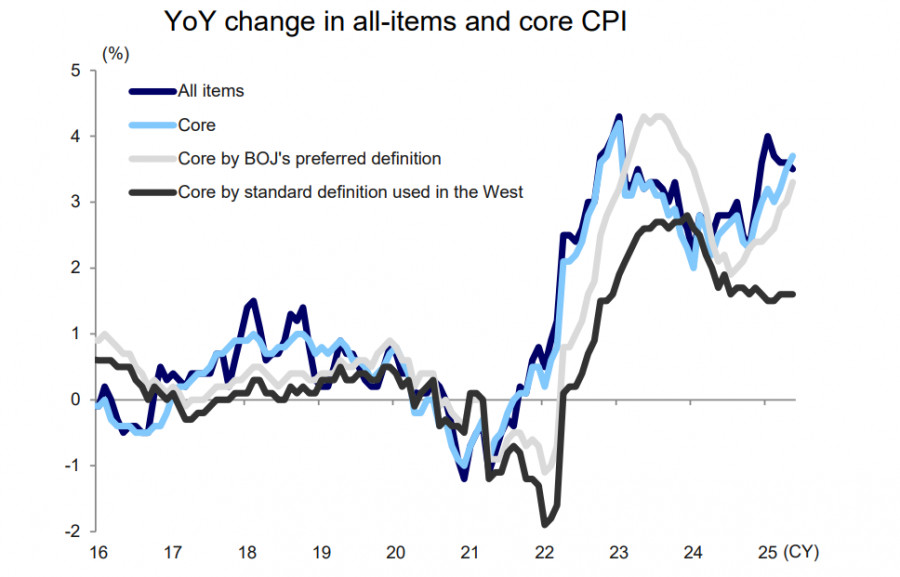

The Yen Has Lost Its Bullish MomentumAuthor: Kuvat Raharjo

12:21 2025-06-27 UTC+2

2263

The EUR/JPY pair is regaining positive momentum during today's trading session, reversing its recent decline.Author: Irina Yanina

12:17 2025-06-27 UTC+2

2173

- EUR/USD: Simple Trading Tips for Beginner Traders for June 27th (U.S. Session)

Author: Jakub Novak

13:11 2025-06-27 UTC+2

2578

- Gold is attracting fresh sellers today, having fallen below the psychological $3300 level.

Author: Irina Yanina

10:47 2025-06-27 UTC+2

2533

- Bitcoin made another attempt to return to the $108,000 level, but failed to hold it and corrected lower ...

Author: Miroslaw Bawulski

15:47 2025-06-27 UTC+2

2518

- GBP/USD: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:16 2025-06-27 UTC+2

2413

- GBP/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:06 2025-06-27 UTC+2

2413

- EUR/USD: Trading Plan for the U.S. Session on June 27th (Review of Morning Trades)

Author: Miroslaw Bawulski

13:01 2025-06-27 UTC+2

2383

- USD/JPY: Simple Trading Tips for Beginner Traders on June 27th (U.S. Session)

Author: Jakub Novak

13:20 2025-06-27 UTC+2

2338

- The Yen Has Lost Its Bullish Momentum

Author: Kuvat Raharjo

12:21 2025-06-27 UTC+2

2263

- The EUR/JPY pair is regaining positive momentum during today's trading session, reversing its recent decline.

Author: Irina Yanina

12:17 2025-06-27 UTC+2

2173