AUDHKD (Australian Dollar vs Hong Kong Dollar). Exchange rate and online charts.

Currency converter

21 Mar 2025 13:47

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

AUD/HKD is not a very popular currency pair on Forex market. AUD/HKD represents the cross rate against the U.S. dollar. Although the U.S. dollar is not obviously presented within this currency pair, it still has a significant influence on it. Thus, by combining AUD/USD and USD/HKD charts, you can get an approximate AUD/HKD chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the U.S. major economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces and many others. Is necessary to note that AUD and HKD can respond differently towards the changes in the U.S. economy, therefore, AUD/HKD currency pair can be a specific indicator reflecting changes within the two currencies.

Hong Kong is famous for having one of the largest stock exchanges. The country leapfrogs a number of major European and American stock exchanges. As of today, Hong Kong takes a leading position among the top financial centers all over the world.

Hong Kong's economy is based on the free market principle, low taxation, and the non-interventional policy. Hong Kong lacks a mineral and food resources, which is why its economy depends on the mentioned above factors. Most of Hong Kong's income is generated by service industries, as well as re-exports from China. In addition, the tourism sector is well developed, too.

AUD/HKD is relatively illiquid compared with major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, while analyzing this financial instrument, one should focus primarily on the currency pairs that include the U.S. dollar.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for this currency pair than for more popular ones, so before you start working with the cross rates, learn carefully the conditions offered by the broker to trade with specified trading instrument.

See Also

- Intraday Strategies for Beginner Traders on March 21

Author: Miroslaw Bawulski

08:20 2025-03-21 UTC+2

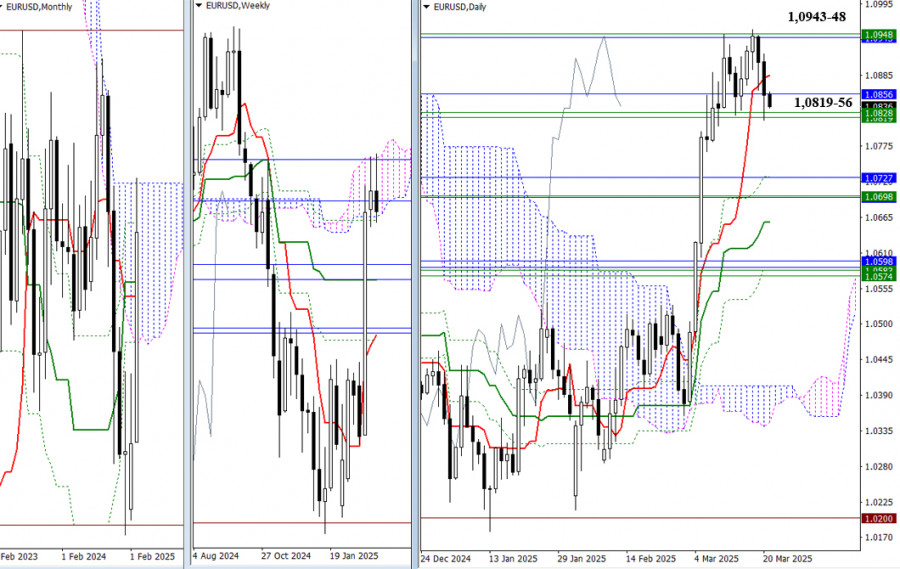

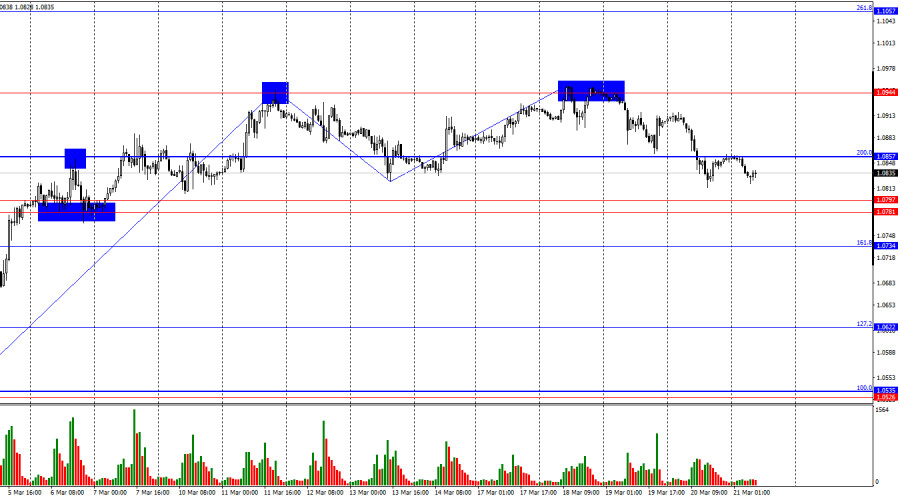

1408

The pair failed to break through the resistance levels of the weekly (1.0948) and monthly (1.0943) Ichimoku clouds, retreating to the support cluster zone across multiple timeframes (1.0819–1.0856). As we wrap up the trading week today, a break and consolidation below this support zoneAuthor: Evangelos Poulakis

07:25 2025-03-21 UTC+2

1348

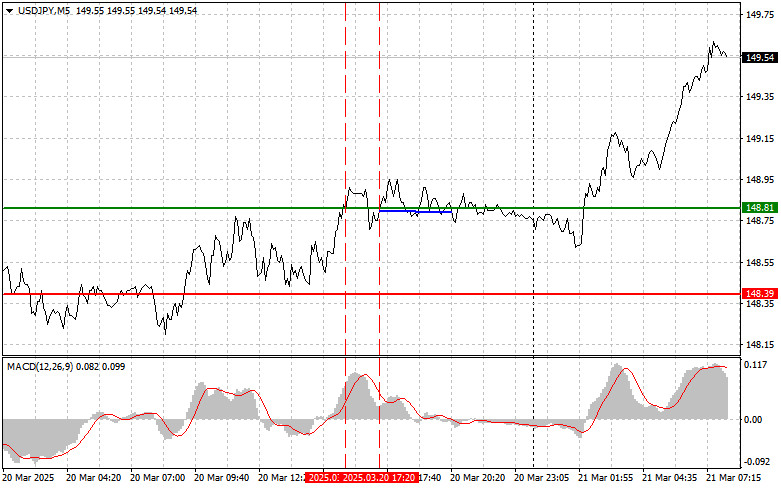

Type of analysisUSD/JPY: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:16 2025-03-21 UTC+2

1318

- Type of analysis

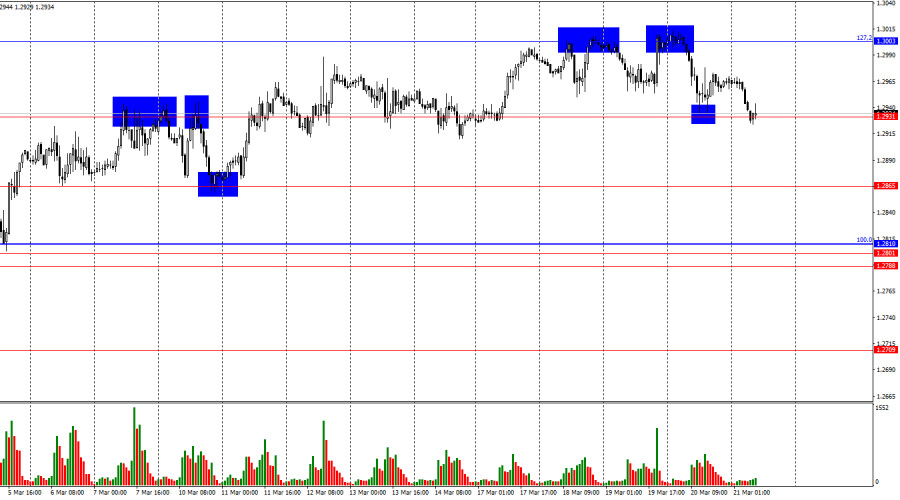

GBP/USD: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:16 2025-03-21 UTC+2

1228

Crypto-currenciesTechnical Analysis of Intraday Price Movement of Bitcoin Cryptocurrency, Friday March 21, 2025.

With the appearance of Divergence between Bitcoin price movements with theAuthor: Arief Makmur

07:18 2025-03-21 UTC+2

1168

The outcomes of the Bank of England and FOMC meetings contradicted each otherAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

1093

- Overview for March 21

Author: Jozef Kovach

11:10 2025-03-21 UTC+2

1078

Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.Author: Irina Yanina

12:07 2025-03-21 UTC+2

1078

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

1078

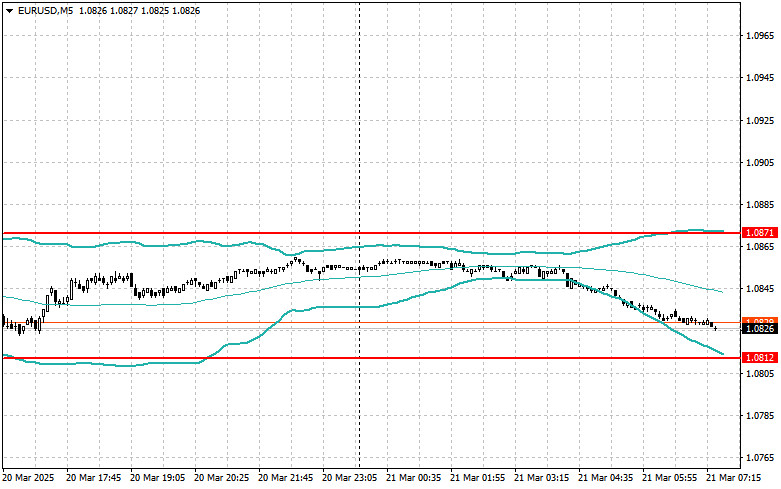

- Intraday Strategies for Beginner Traders on March 21

Author: Miroslaw Bawulski

08:20 2025-03-21 UTC+2

1408

- The pair failed to break through the resistance levels of the weekly (1.0948) and monthly (1.0943) Ichimoku clouds, retreating to the support cluster zone across multiple timeframes (1.0819–1.0856). As we wrap up the trading week today, a break and consolidation below this support zone

Author: Evangelos Poulakis

07:25 2025-03-21 UTC+2

1348

- Type of analysis

USD/JPY: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex Trades

USD/JPY: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:16 2025-03-21 UTC+2

1318

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 21. Review of Yesterday's Forex TradesAuthor: Jakub Novak

09:16 2025-03-21 UTC+2

1228

- Crypto-currencies

Technical Analysis of Intraday Price Movement of Bitcoin Cryptocurrency, Friday March 21, 2025.

With the appearance of Divergence between Bitcoin price movements with theAuthor: Arief Makmur

07:18 2025-03-21 UTC+2

1168

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1093

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

1078

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

1078